Money Minutes for Doctors #24 - Finances in the Time of COVID

The human devastation of COVID-19 is without peer…but the economic effects are not close behind. In this episode we discuss how the novel Coronavirus has altered the world’s financial landscape and how to survive the veritable hurricane that is currently ravaging the global economy. Without question, the steps we take now will help us survive into the future (physically and financially). Here to discuss the emerging and ever changing financial reality is Ms. Katherine Vessenes.

About Ms. Vessenes:

Ms. Vessenes works with over 300 physicians and dentists from Hawaii to Cape Cod. Her firm uses a team of experts to provide comprehensive financial planning to help doctors build their wealth and protect their wealth while reducing taxes now and in the future. Katherine is a longtime advocate for ethics in the financial services industry; and has written three books on the subject of investment strategies. She has received many honors and awards including: numerous tributes from Medical Economics as a top advisor for doctors, multiple 5-Star Advisor Awards, honored as a Top Woman in Finance, in addition to being selected to be on the CFP® Board of Ethics. Katherine can be reached at: Katherine@mdfinancialadvisors.com or 952-388-6317. Her website: www.mdfinancialadvisors.com.

QUICK SUMMARY:

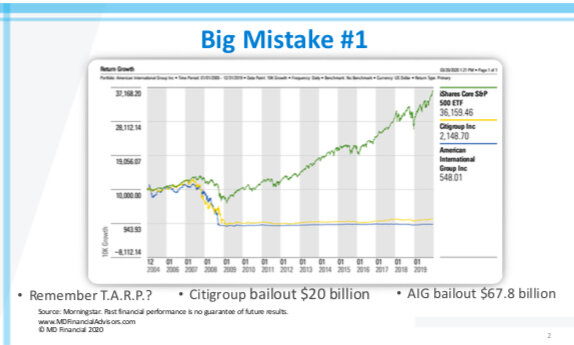

Financial Mistakes in the time of COVID

Do NOT make significant stock purchases in unstable markets. i.e. do NOT buy airline or cruise line stock at this time.

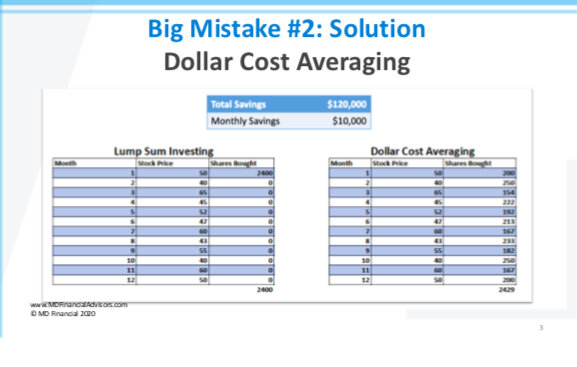

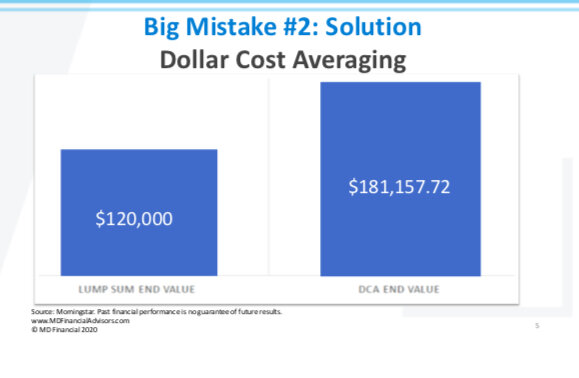

Do NOT stop your monthly investments – dollar cost averaging is a techniques used to minimize risk - see example below (power point slide #3-5). You buy more shares when market down and less when market is up – result is more shares for the same initial investment vs. the Lump Sum investor.

If you sell now you solidify your loses and also risk losing out on the run up.

Make sure you are Dr. Blue

Do not make any major investments at this time. Do not buy the expensive house or engage in expensive remodeling projects. If you want projects done get bids and wait a few months as expectation is that labor may be cheaper moving forward.

Do NOT sit on your cash – you risk being Dr. Green and miss out on the runup when market recovers.

The market always recovers

Do not change your investment strategy at this time

If you do change be ready to commit for several years.

Don’t panic, trust in the process

Action Steps to optimize your position

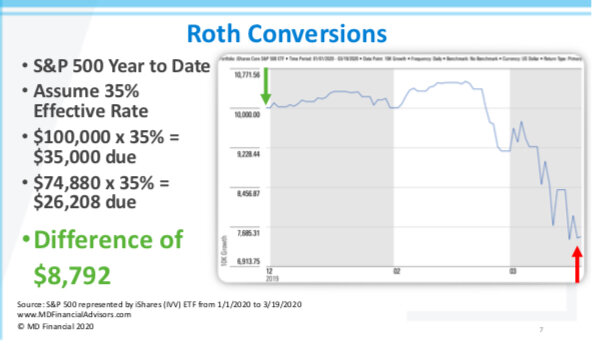

Convert to Roth IRA (Roth conversions Slide #7)

you will have to pay the taxes on this conversion but not due to following year

Benefit from low tax rates, potential loss in income which means a lower tax bracket and the low market will optimize this conversion

Back Door Roth IRA - $6,000 per person or $7000 if > 50 yo.

If you do now buy more shares at lower prices

Taxes are paid up front and growth is tax free provided you don’t pull it out before 59 ½.

Good choice as long as don’t need that money for next several years.